I find this absolutely amazing. First I'm not the type of person to bring something up without what I consider to be objective proof, last night when I brought up the fact that bullish signals in risk currencies that should send the market higher and did for a short while, "looked" fishy to me, that was this post, last night.

The exact words were...

" looking at the charts. something doesn't look right, it's not consistent yet through single currency futures and the pairs, but for example, the Euro which moved up, has a worsening negative 3C tone, the Dollar should look worse, but almost looks as if it's about to transition to a more positive stance. R2K Futures have a negative divergence and couldn't make a new high."

While ES and NQ were making higher highs, what I saw in the IWM stuck out, it didn't look right and what happened after that? All of the Index futures topped right there and headed lower. The Euro which had a positive 3C divergence, but the tome of 3C was going negative on a brand new positive, what happened? The Euro and all other risk pairs including the Aussie that rallies much higher on eco-data-all fell overnight as did of course the R2K futures.

This was not what I'd normally bring up, but after years and years of using 3C, something just wasn't sitting right.

That happened again this morning/afternoon starting with this post, "Not to Get Ahead of Myself" in which I said,

"In any case, I may be getting ahead of myself as this may just be an intraday wiggles, but this is also how a new move starts. I see weakness and some negatives already brewing in the risk currencies, Euro, $AUD, EUR/USD, etc which are coming off swing lows, they should move higher, but are already showing 3C weakness as the $USD is showing 3C strength-just as I said last night and this morning, something doesn't look right with this market!"

Then this post followed..."Currency Update" which documented exactly what I was talking about above, again a situation that wasn't screaming, but something wasn't right with the market and FX.

I suspected that the positive divergence was turning negative and the risk currencies would fall, here's what happened next just a bit ago.

The Euro, as I was suspecting, dropped lower instead of rallying.

The AUD did the exact same.

The $USD which was suppose to move down, but I suspected it would move up- look.

The EUR/USD which was set for a move up, but something again wasn't right, instead a move down.

The thing is, these aren't just moves in the opposite direction, these are HUGE moves in the opposite direction to new lows and highs for the week. The market is telling us something.

The EUR/JPY as JPY weakened considerably

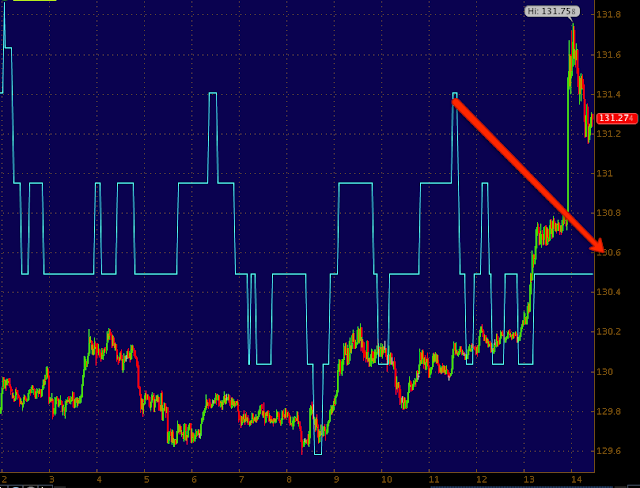

USD/JPY as USD strengthen and JPY weakened considerably.

And the Yen, you saw the correlation.

In my view, these subtle red flags on existing signals is the market telling us the AAPL scenario is taking hold, some are breaking away from the flock out of fear which we know exists among smart money because we can see it all week and even longer in TLT and VIX Futures, there's a massive flight for protection and safety.

Beware.

No comments:

Post a Comment