So far so good here too...

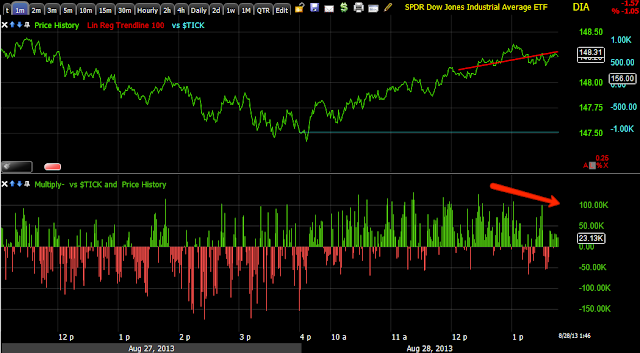

First of all an intraday indicator I mentioned earlier looks like the market will do as expected.

The NYSE TICK Indications show the market likely to pullback, this is my own custom version, but as we saw earlier, that was the highest intraday probability as TICK fell out of the channel.

Longer term, but not too long...

Commodities are weaker today relatively vs SPX, this seems to be a discounting of the War Premia.

Yields and the SPX are almost perfectly in line so the magnetic pull of yields on equities right now is pretty non-existient.

Sentiment from HIO is looking even better while retail is still bearish and easily spooked, it would take a heck of a strong day to get them trusting the market again, but likely not more than a day as they are VERY fickle right now from being thrashed around.

VXX w/ an inverted SPX shows there's not much difference in performance of the VIX futures today, the 5 min VIX futures chart I showed earlier is the most important and it's suggesting the market is preparing for a move higher.

HYG Credit is leading the SPX so this is what we want to see, but it's short term like a bounce, it's not a week or month long divergence so we can gain some scale perspective.

Finally (for now), I'm happy to see the skittish (because of the thin liquidity) High Yield Credit (A Smart Money Risk Asset) to be diverging even higher vs the SPX, this shows smart money seems to be preparing for a move higher as well, most technical traders have no idea to look for this.

So I think the thesis we have been working on is still good, it's a matter oof trade management, some new positions and finding set ups we like for the big picture on a bounce as well as making sure nothing creeps up on us that we could have controlled (unlike a surprise attack on Syria, but we may even be able to read that if smart money knows it).

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment